Random price generator for stock market simulation. More...

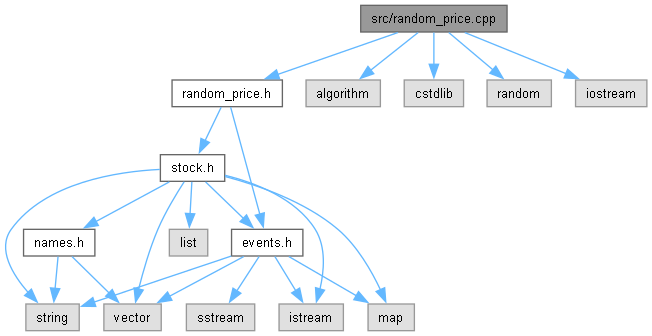

#include "random_price.h"#include <algorithm>#include <cstdlib>#include <random>#include <iostream>

Go to the source code of this file.

Functions | |

| std::map< stock_modifiers, float > | getProcessedModifiers (Stock stock) |

| Get the processed modifiers for the stock. | |

| float | init_sd (void) |

| Initialize the standard deviation of the stock price. | |

| float | init_stock_price (int price_profile) |

| Initialize starting stock price. | |

| float | percentage_change_price (Stock stock) |

| Calculate the percentage change of the stock price. | |

| unsigned int | random_integer (unsigned int max_integer) |

| python randint like function | |

Detailed Description

Random price generator for stock market simulation.

Definition in file random_price.cpp.

Function Documentation

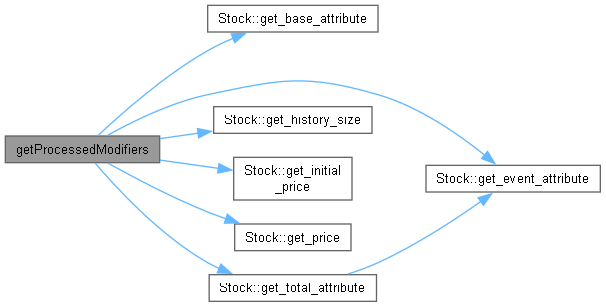

◆ getProcessedModifiers()

| std::map< stock_modifiers, float > getProcessedModifiers | ( | Stock | stock | ) |

Get the processed modifiers for the stock.

- Parameters

-

stock the stock to get the processed modifiers

- Returns

- the processed modifiers

- Note

- the values of the processed modifiers are final values that will be used to calculate the percentage change of the stock price

Definition at line 54 of file random_price.cpp.

References defaultLowerLimit, defaultUpperLimit, Stock::get_base_attribute(), Stock::get_event_attribute(), Stock::get_history_size(), Stock::get_initial_price(), Stock::get_price(), Stock::get_total_attribute(), lower_limit, lowerLimitMultiplier, mean, meanMultiplier, sdMultiplier, standard_deviation, upper_limit, and upperLimitMultiplier.

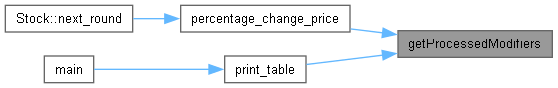

Referenced by percentage_change_price(), and print_table().

◆ init_sd()

| float init_sd | ( | void | ) |

Initialize the standard deviation of the stock price.

Definition at line 36 of file random_price.cpp.

Referenced by Stock::Stock().

◆ init_stock_price()

| float init_stock_price | ( | int | price_profile | ) |

Initialize starting stock price.

| a | mean | s.d. |

|---|---|---|

| 1 | 5 | 2 |

| 2 | 50 | 20 |

| 3 | 150 | 50 |

- Parameters

-

a the profile of the stock price

- Returns

- the initial stock price

Definition at line 23 of file random_price.cpp.

Referenced by Stock::Stock().

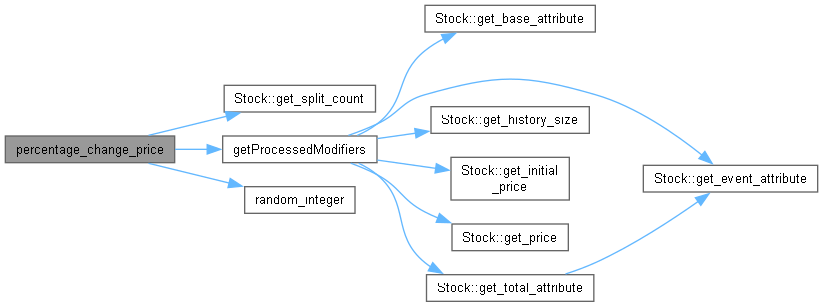

◆ percentage_change_price()

| float percentage_change_price | ( | Stock | stock | ) |

Calculate the percentage change of the stock price.

- Returns

- the percentage change of the stock price

- Parameters

-

stock the stock to calculate the percentage change

Definition at line 114 of file random_price.cpp.

References Stock::get_split_count(), getProcessedModifiers(), lower_limit, mean, random_integer(), standard_deviation, and upper_limit.

Referenced by Stock::next_round().

◆ random_integer()

| unsigned int random_integer | ( | unsigned int | max_integer | ) |

python randint like function

- Parameters

-

max_integer the maximum integer + 1 that can be returned

- Returns

- a random integer in

[0, max_integer - 1]

Definition at line 45 of file random_price.cpp.

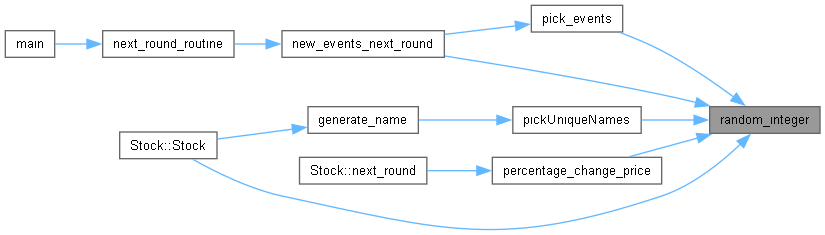

Referenced by Stock::Stock(), new_events_next_round(), percentage_change_price(), pick_events(), and pickUniqueNames().